Immediate vs. deferred annuities differ in when the payments begin. Annuity returns depend on several factors, including the type of account and the performance of the index it’s attached to. Insurance companies also usually put caps on the interest rate that an annuity can earn.

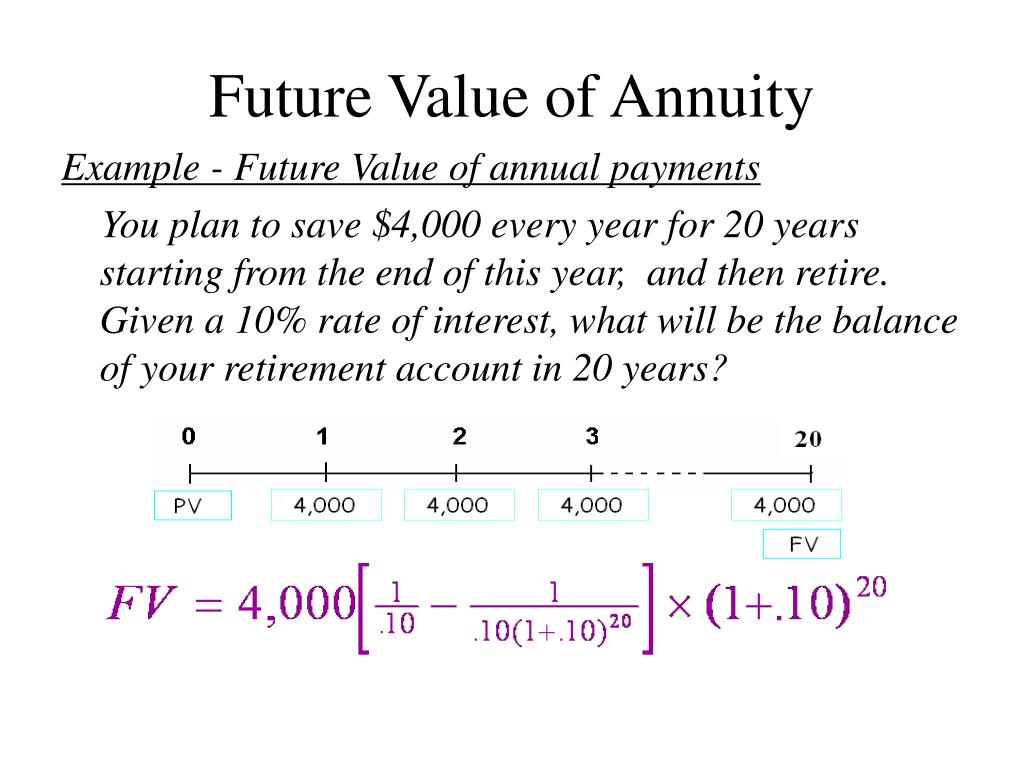

- So, for example, if you plan to invest a certain amount each month or year, FV will tell you how much you will accumulate as of a future date.

- This can be particularly important when making financial decisions, such as whether to take a lump sum payment from a pension plan or to receive a series of payments from an annuity.

- In the previous section, we hope we provided some insight into how a simple annuity works.

- For now, focus strictly on the variables and how to illustrate them in a timeline.

Saving for retirement with annuities

Lifetime annuities may not be suitable if you need flexibility with your income or want to have future access to all your pension fund. An annuity is a continuous stream of equal periodic payments from one party to another for a specified period of time to fulfill a financial obligation. An annuity payment is the dollar amount of the equal periodic payment in an annuity environment. The figure below illustrates a six-month annuity with monthly payments. Notice that the payments are continuous, equal, periodic, and occur over a fixed time frame.

Present Value and the Discount Rate

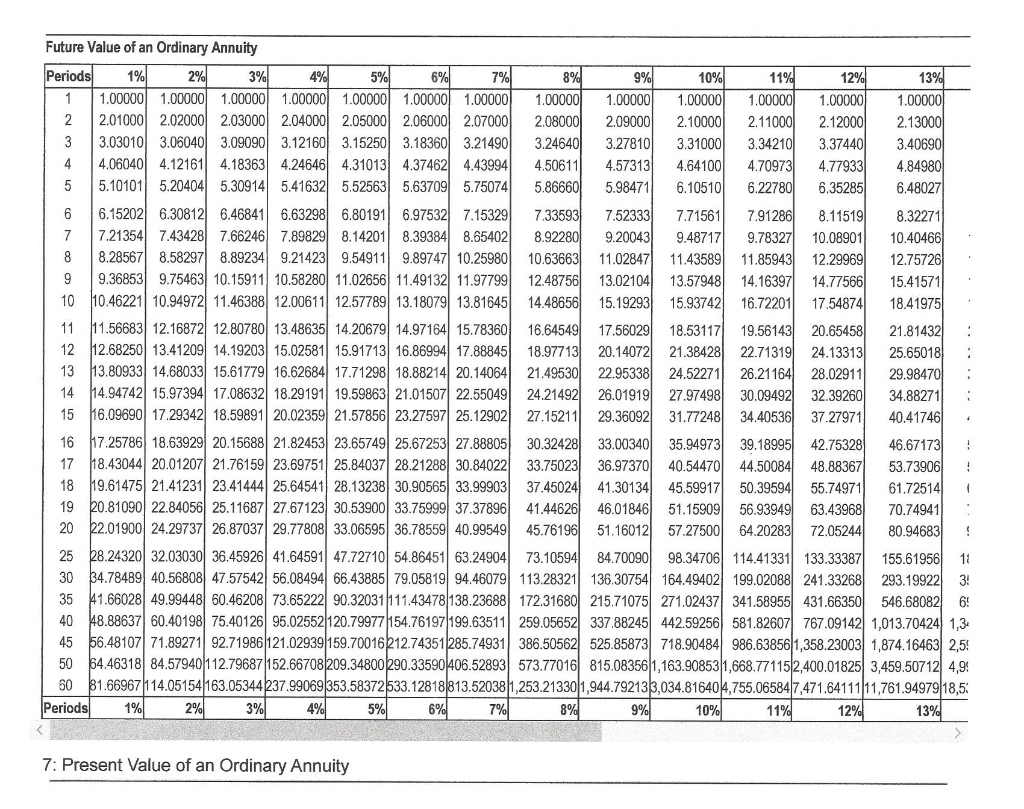

You can calculate the present or future value for an ordinary annuity or an annuity due using the formulas shown below. Each annuity payment is allowed to compound for one extra period. Thus, the present and future values of an annuity-due can be calculated.

Securing your income stream in retirement

Because of the time value of money, money received today is worth more than the same amount of money in the future because it can be invested in the meantime. By the same logic, $5,000 received today is worth more than the same amount spread over five annual installments of $1,000 each. For instance, if half the value of the annuity is exchanged for a second annuity, the new annuity will take half the cost basis.

Annuity Ready allows you to compare lifetime annuity quotes online. The present value of annuity calculator is a handy tool that helps you to find the value of a series of equal future cash flows over a given time. In other words, with this annuity calculator, you can compute the present value of a series of periodic payments to be received at some point in the future. Athene sold 34.6 billion in fixed annuities in 2023, the most of any company reviewed by LIMBRA. Athene Agility annuities are guaranteed not to lose money and provide a guaranteed income stream with a death benefit rider at no additional charge. It’s important to note that the discount rate used in the present value calculation is not the same as the interest rate that may be applied to the payments in the annuity.

Annuity providers will usually pay a higher income the older you are when you buy. But changes in the market may affect future annuity rates as well as the value of your pension fund. A pension lifetime annuity provides a guaranteed income for the rest of your life.

The formulas described above make it possible—and relatively easy, if you don’t mind the math—to determine the present or future value of either an ordinary annuity or an annuity due. Such calculations and their results can add confidence to your financial planning and investment decision-making. Present value tells you how much money you would need now to produce a series of payments in the future, assuming a set interest rate.

If any one of these four characteristics is not satisfied, then the financial transaction fails to meet the definition of a singular annuity and requires other techniques and formulas to solve. The amount of annuity income you receive will depend on the annuity rate you were offered by your chosen provider. This is based on the options you selected when buying your lifetime annuity.

If you decide to buy a lifetime annuity, your current pension provider will release your funds to your annuity provider. You should receive your first annuity payment in line with the payment options you selected at the point of purchase. If they do, it is important to provide it as soon as possible to avoid delays. Individuals can typically buy into a retirement annuity with either a lump-sum payment or a series of payments.

The basic idea behind these insurance products—a guaranteed stream of income, often for a lifetime—sounds pretty appealing. However, critics are quick to point out that they also have a lot of drawbacks, not least of which is their cost compared with other investment options. Before signing a contract, make sure you annuity in advance understand both the pros and cons. You may hear about a life annuity where payments are handed out for the rest of the purchaser’s (annuitant) life. Since this kind of annuity is only paid under particular circumstances, it is called a contingent annuity (i.e., it is contingent on how long the annuitant lives for).